ADVERTISEMENTS:

In this article we will discuss about the finance commission in India.

Introduction to the Finance Commission in India:

Till 1995 President of India had set up ten Finance Commissions. Each such Commission has increased states of finances share of finances and thus it can be said that the states have always been the gainers.

In the words of Plyee, “In fact, the Commission acts a buffer between the Union and the States, checking the clamorous, finance hungry states but upon applying their political pressure on the union and, at the same time, making the latter give as much as possible to the needy states. It will almost be impossible for the Union to go against the recommendations of the Commissions.”

But of late Commissions have been complaining that Planning Commission has been trying to over shadow them. Fourth Finance Commission pointed out, “When the Finance Commission begins its work, it has to keep in view the available financial resources and plan needs. The result is that it has to function more or less within the lines already laid down by the Planning Commission.”

But even then there have been no conflicts between the two Commissions. The Planning Commission always keeps in view the recommendations of Finance Commission and financial resources which are likely to become available to each state before making its final recommendations.

Similarly Finance Commission also does not altogether ignore plan needs of a state before making recommendations to the President about financial requirements of the states.

First Finance Commission:

It was appointed in November 1951, under the chairmanship of K.C. Neogy, ex-member of the Union Cabinet. He was a full time chairman and it was expected of the Commission to submit its report within a period of one year.

The term of Commission was, however, extended up to 30th December, 1952. V. P. Menon, an administrator was its part time member. V. L. Mehta, a Gandhian; R.K. Rao, a High Court Judge; B. K. Madan, an economist and M.V. Rangachari, an administrator were four full time members of the Commission.

ADVERTISEMENTS:

Major recommendations of the Commission were:

(a) The states should get 55 per cent instead of 50 per cent from the net proceeds of income tax, out of divisible pool.

(b) Excise duties on tobacco, etc., are most suited for distribution among the states.

(c) 40 per cent of the levies on tobacco, match boxes and vegetable products should be given to the states.

ADVERTISEMENTS:

(d) Grant-in-aid on jute export duty should be fixed sums.

(e) Grant-in-aid should be given keeping in view budgetary needs of the stales.

(f) While deciding financial needs of a state maintenance of standard of social services should be taken care of.

(g) Grants should be paid more liberally to less advanced states.

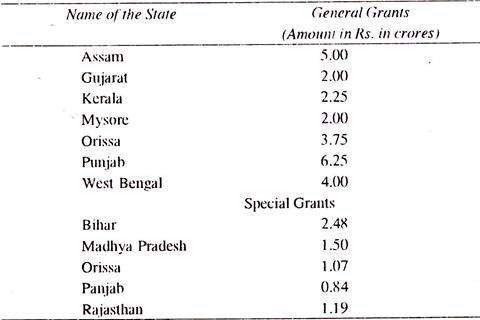

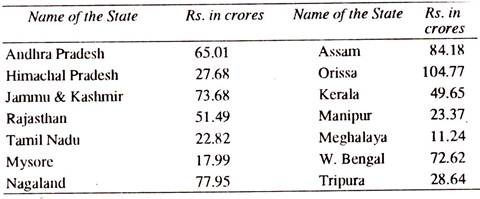

It recommended general and special grants to some of the states as under:

Second Finance Commission:

It was set up in June 1956 and was headed by lull time chairman, K. Santhanam, who was again a Union Cabinet Minister. It continued to work till September, 1957.

The Commission had one part time member, B.N. Ganguli, an economist and M.V. Rangachari. another economist, who was also member of First Finance Commission. Other two full time members of the Commission were Ujjal Singh a politician and L. S. Misra, an ex-High Court Chief Justice.

It dealt with divisible central taxes and the principles which should govern the grants-in-aid from the Centre to the States and modifications of the terms of agreements entered into by the central government and the states.

The recommendation of the Commission provided for a transfer of about Rs.140 crores per year as against an average sum of Rs.93 crores received by the states under the First Finance Commission recommendations.

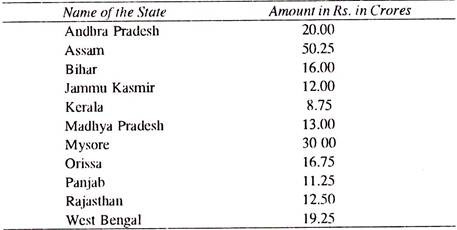

It recommend general grants to the slates as follows:

Third Finance Commission:

It was set up in December 1960 and given a term of one year. It submitted its report on December 14,1961. It was headed by a part time Chairman, A. K. Chanda, an ex-Comptroller and Auditor General of India. It had 4 lull time members, namely, P. Govinda Menon a politician; D. N. Roy, an ex-High Court Justice; M. V. Mathur, an economist and G. R. Klamath, an administrator.

The government accepted almost all recommendations of this Commission. It discussed such problems as the share of the states in estate duty, grant-in-aid in lieu of tax on railway passenger fares, income tax, Union excise duty on 35 schedule articles and grants-in-aid under substantive portion of Article 275 (1).

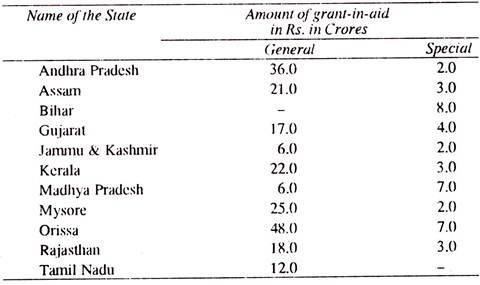

The Commission also recommended, grant-in-aid both general and special to the states, as follows:

Fourth Finance Commission:

It was set up on May 5, 1964 and its report became available on September 10, 1965. It was headed by a part time chairman P.V. Rajamanner, ex-High Court Chief Justice.

Its other members were M.L. Gautam, a politician; D.G. Barva, Deputy Governor, Reserve Bank; Bhabantosh Dutta, an economist; and P. C. Mathew, a professional administrator. It recommended that state’s share in income-tax should be raised from 66.2% to 75%. It also suggested that grant-in-aid to states should be increased from Rs.64 crores to Rs.140 crores.

The share of each state would continue to be determined on the basis of 80% on population and 20% on collection.

Commission’s another recommendation which was accepted by the government was that the state should share 20% of yield from excise duty on all commodities instead of only 35 commodities as was the position at that time. The Commission recommended that 10 states should be given grant-in-aid of Rs.121.89 crores, as against 12 states which were getting a total grant-in-aid of Rs.63.75 crores.

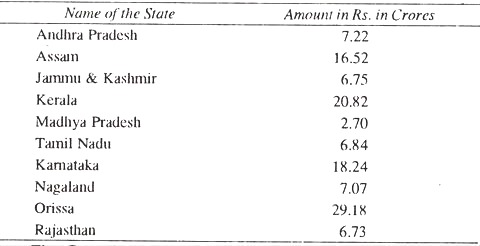

Grant-in-aid, as recommended by the Commission in respect of each state was:

The Commission also suggested that jurisdiction of Finance Commission and Planning Commission should be clearly demarcated.

Fifth Finance Commission:

It was on 29th February, 1968 that the setting up of Filth Commission was announced. The Commission started its work in March 1969 and completed that in June 1970. It was chaired by a part time chairman, Mahavir Tyagi, who was a former-Union Minister.

The Commission had two part time members; namely, P.C. Bhattacharya ex-Governor of Reserve Bank of India and G. Swaminathan, an administrator. It had also three full time members, namely, M. Seshachatapatty, ex-High Court Judge; Prof. D.T. Lakadawala, an economist and V. L. Gidwani, an administrator.

The Commission seriously viewed the problem of over-drafting by some of the states, which were in no way less prosperous. In the view of the Commission this tendency was very adversely effecting national economy. It felt that such an over drafting was either to overcome temporary difficulties because of uneven flow of income and expenditure or due to imbalance between their resources and functions.

The Commission opined that in case this tendency was not discouraged, it could become infectious. The Commission said that all states should balance their budgets and urged the central government to consider more frequent releases of share of income tax during the last two quarters.

It urged the Union Government to help the state governments to clear the over drafts by offering suggestions and active co-operation. This became very controversial recommendation because many states felt that over-drafting sometimes became unavoidable.

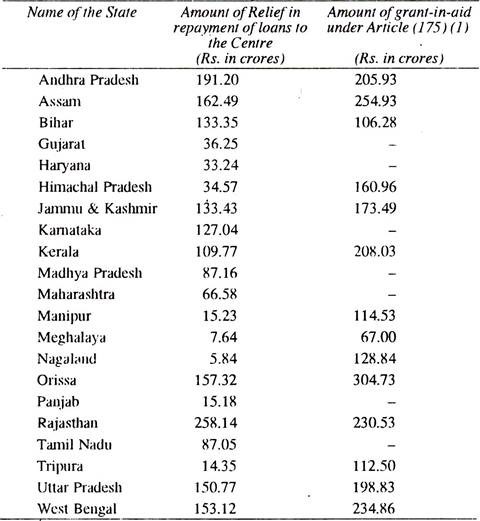

The Commission recommended following grants to the states, under Art 275 (1) of the Commission:

Sixth Finance Commission:

The appointment of the Commission was announced on 28th June, 1972 and its report was submitted to the President on 28th October, 1973. It was placed on the Table of both the Houses of Parliament on 18th December, 1973. The Commission was headed by a full time chairman, K. Brahmanand Reddy, a politician. It had two full and two part time members.

The former were Syed S. A. Masud, ex-High Court Judge and G. Ramachandra, an administrator; whereas the latter were Prof. B. S. Minhas and Professor I. S. Gulhati, both economists, its major recommendations were:

(i) The states should be given relief by extending repayment period.

(ii) There should be no write off of debts of loans given by the Centre to the states.

(iii) Existing distribution formula for income to the states from income tax and excise duty was adequate.

(iv) The Commission suggested the Centre to transfer amount payable to the states during five years ending 1979.

(v) The Commission was of the view that there should be scheme for financing relief expenditure to the states affected by natural calamities.

(vi) In regard to grant on account of wealth tax on agricultural property the Commission’s recommendation being that the amount be distributed among the states in proportion to the value of agricultural property located in each state and brought to assessment in that year.

While making recommendations the Commission felt that backward states should be given more weightage. While measuring backwardness, the Commission adopted the criteria of per capita expenditure on administrative and social services.

Financial recommendations of the Commission were:

Seventh Pay Commission:

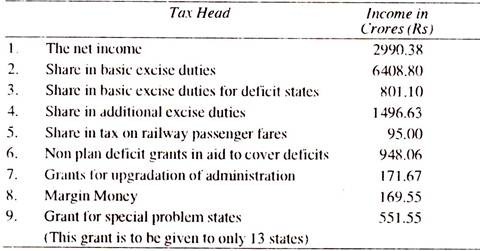

The Seventh Finance Commission was constituted in June, 1977 under the chairmanship of Justice J. M. Shelat, former Judge of the Supreme Court. Its other members were Prof. Raj Krishna, C.H. Hanumantha Rao, an economist; H. N. Ray, former Finance Secretary and V. B. Eswaran, Adviser, Planning Commission. It recommended devolution of taxes and duties and grants-in-aid to the states.

The Commission submitted its report in October, 1978. It suggested raising the share of the states in income tax from 80 to 85% and doubled the share of states in basic excise duty other than electricity. The Commission also recommended grants totaling Rs.1,173 crores during the period 1979-84 to eight states which were likely to have gap in their revenue accounts.

The Commission also recommended Rs.437 crores to 17 out of 22 states for upgradation of standards in certain sectors of administration. It also recommended wiping out of central loans to the states to the extent of Rs.943 crores and debt relief of Rs.2,156 crores. The transfers under Commission’s awards were of the order of Rs.23,063 crores. The period covered was 1979-84.

Eighth Finance Commission:

It was set up by the President of India under the chairmanship of Y.B. Chavan, ex-Finance Minister of India. Its other members were S.S. Mukherji, judge of Calcutta High Court Prorf. C.H.; Hanumanlha Rao, Member, Planning Commission; B.C. Baweja, Secretary, Ministry of Finance and A.R. Shirali, Deputy Comptroller Auditor General of India.

It submitted its final report on 30-4-1984. The fiscal transfers for the period 1984-89 were estimated by the Commission at Rs.39,452 crores representing a step up over 89% on the transfers envisaged by the Seventh Finance Commission.

It recommended a grant-in-aid of Rs.1,503 crores to cover deficit of 10 states. Additional grant of Rs.509.29 crores was recommended in the case of 11 deficit states. Grant-in-aid of Rs.914.55 crores to 16 states was recommended for upgradation of standards of administration in certain fields.

The Commission recommended a grant of Rs.52.78 crores to ten states tor tackling social problems. It also recommended Rs.602 crores to all the 22 states for financing of relief expenditure in connection with natural calamities. Thus, total devolution to states was to the tune of Rs.38,500 crores over the five year period.

Ninth Finance Commission:

It was been set up under the chairmanship of N.K.P. Salve. Its other members were justice Abul Saltar Querishi; judge of the Gujarat High Court; Dr. Raja Challiah, the then member Planning Commission; Lalthanlhawla, former Chief Minister of Mizoram and Mahesh Parsad, Adviser to the Planning Commission.

The Commission recommended transfer of Rs.13668 Crores to the states for the year of 1989-90; the last year of Seventh Five Year Plan as follows:

ADVERTISEMENTS:

The Commission recommended the continuance of scheme of financing relief expenditure recommended by Eighth Finance Commission.

It also recommended a moratorium on interest payments and repayment of principal due in 1989-90 of the Central loan given to the states in 1986-87 and 1987-1988 by way of additional plan assistance towards approved relief expenditure on account of unprecedented drought during those two years.

Tenth Finance Commission:

Tenth Finance Commission under former Union Defence Minister K.C. Pant has been set up. It has four members, namely, Dr. D.P. Pal a politician; B.P.R Vithal, former Andhra Pardesh Finance Secretary; C. Ranga Rajan, Member Planning Commission and M.C. Gupta former Haryana Chief Secretary; who will also act as Secretary to the Commission.

Every Finance Commission has proposed higher amount to the states and in this way gradually financial dependence of the states on the Centre is likely to come down. But still the journey is long because liabilities of each state are also very much increasing.

Each and every state is becoming more and more ambitious, but healthy trend is that Finance Commissions are now stressing on the advancement of backward states so that regional imbalances arc quickly removed and whole of India progresses uniformally.